Reduce taxes on a Roth IRA conversion with charitable giving

Coauthors:

Caleb Lund, CAP®

Director of Charitable Strategies Group

DAFgiving360TM

Hayden Adams, CPA, CFP®

Director of Tax Planning and Wealth Management

Schwab Center for Financial Research

Many people consider converting their traditional IRA (or other tax-deferred retirement account) to a Roth IRA to continue growing their wealth tax-free, but with the added benefit of no taxation when they withdraw funds during retirement.

The primary benefits of a Roth IRA are tax-free growth, tax-free withdrawals (if holding period and age requirements are met), no annual RMD, and elimination of tax liability for beneficiaries (depending on the timing). Also, a Roth IRA’s typical contribution limits don’t apply to a conversion.

However, you can’t completely escape taxes: you’ll owe income taxes on the amount converted for the year the conversion takes place. That can mean a big tax bill.

But, if you already regularly donate to charity or are considering it, you could use those donations to help cancel out the taxes you’d owe from the Roth IRA conversion. Using this strategy, you may be able to support causes you care about while potentially reducing your tax burden.

How to potentially offset tax liability on a Roth IRA conversion with charitable giving

Step-by-step, here’s how it would work for those who itemize deductions:

Convert money from a traditional IRA to a Roth IRA.

That amount is added to your income for the year and taxed accordingly.

Make a charitable donation in the same tax year.

Claim an itemized deduction for the donation to offset some or all of the taxable income from the Roth conversion.

Basically, a Roth IRA conversion creates taxable income, but by making a charitable contribution in the amount you converted and claiming an itemized charitable deduction, you could reduce your tax bill.

You also don’t have to gift the same amount as the conversion. For example, a person could convert $1M to a Roth IRA from a traditional IRA and gift $250k to a charity, including a donor-advised fund (DAF), and still get a deduction. It’s only if you wanted to offset the entire tax liability via charitable donation that you’d need to give the same total amount as the amount converted.

This high-net-worth tax strategy is especially powerful if you donate money into a DAF account. A DAF is a charity and lets you make a large charitable contribution all at once, get the tax deduction now, and then spread out the donations (grants) to nonprofits over time.

Bonus: scheduled, recurring donations help nonprofits predict and plan their budgets. Of course, you can always donate all at once if you prefer.

Case study: Roth IRA conversion combined with charitable donation

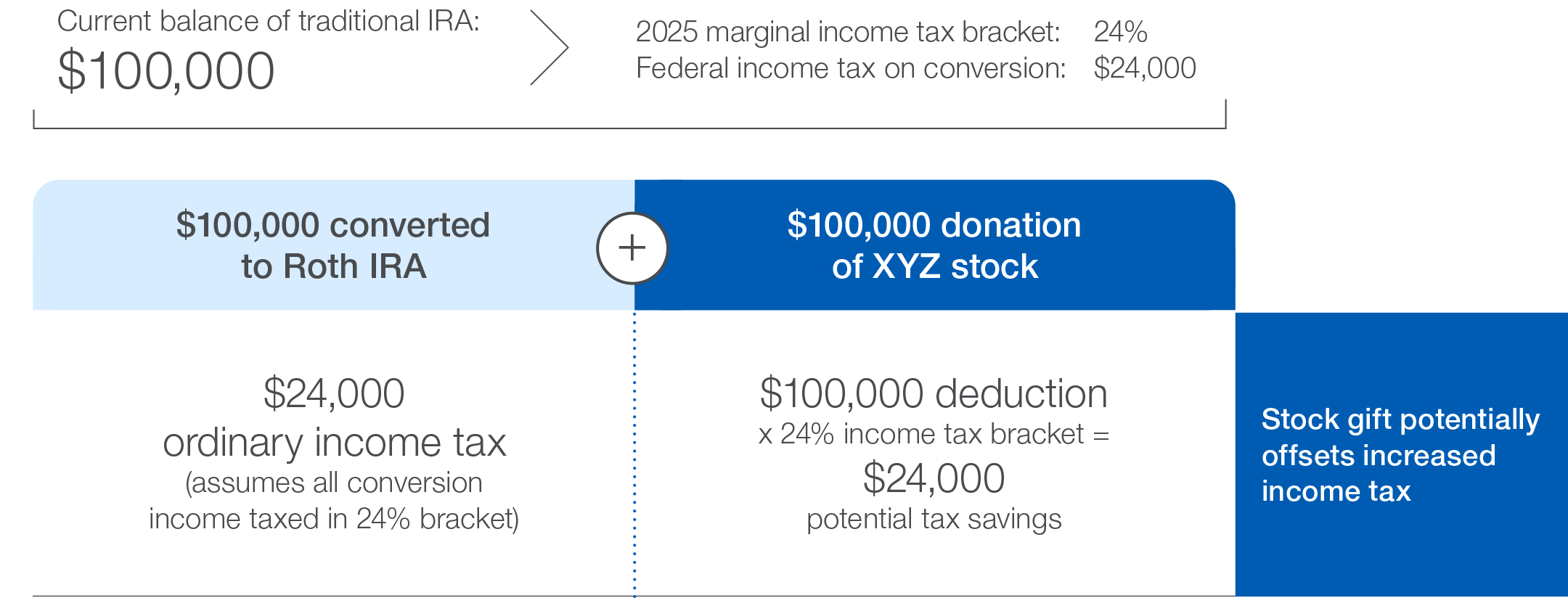

Olivia wants to convert a traditional IRA to a Roth IRA. Her traditional IRA has a balance of $100,000. The amount converted is treated as ordinary income, even though it’s not considered a withdrawal.

Olivia will be in the 24% income tax bracket, so her income tax on the conversion would be $24,000. This would be a large and unexpected tax bill but also a tradeoff for having tax-free withdrawals from the Roth IRA in retirement.

Olivia’s financial advisor suggests that she could increase her charitable giving this year to $100,000, an amount that entirely offsets the income tax on the conversion. She makes a large donation and claims a charitable deduction that offsets her tax liability on converting her traditional IRA to a Roth IRA.

*This hypothetical example is only for illustrative purposes. The example does not take into account any state or local taxes or the Medicare net investment income surtax.

What you can do next

For questions or assistance with philanthropic planning or charitable giving, you and your advisors may:

Talk to a charitable specialist at 855-966-3764

Follow DAFgiving360 on LinkedIn