Fiscal Year 2025 Giving Report

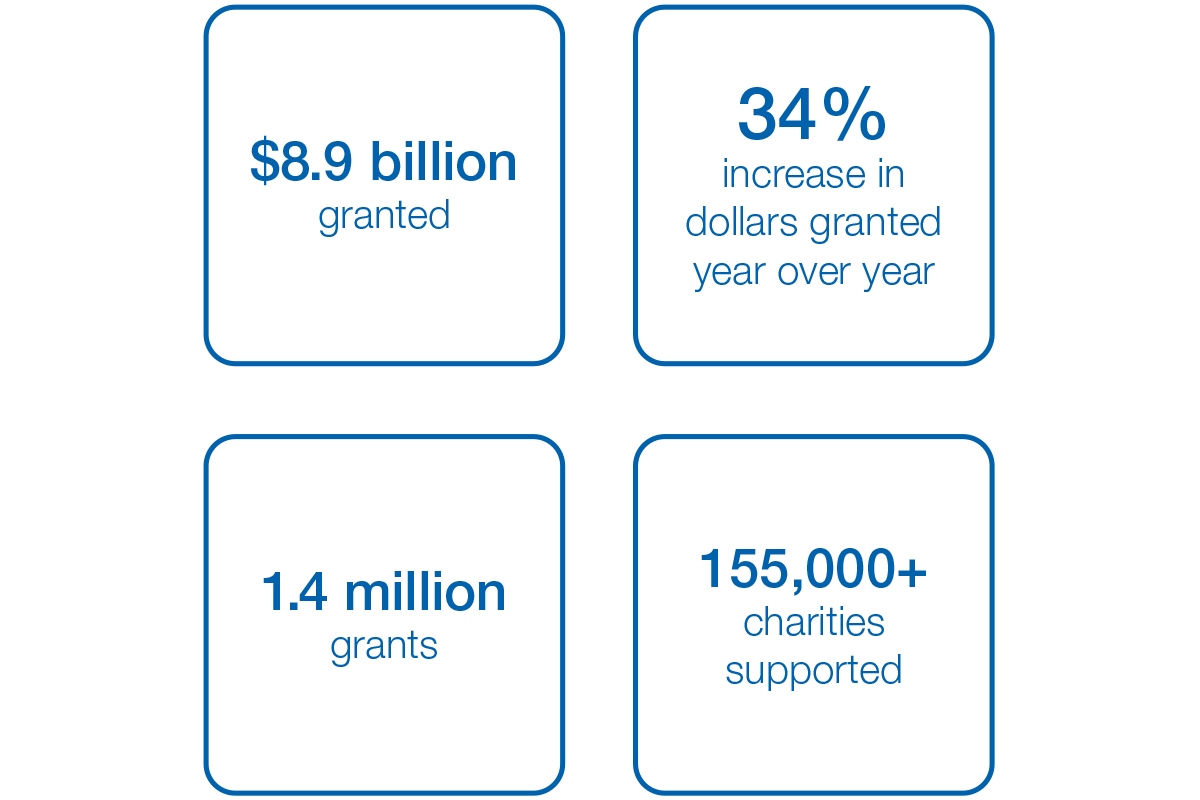

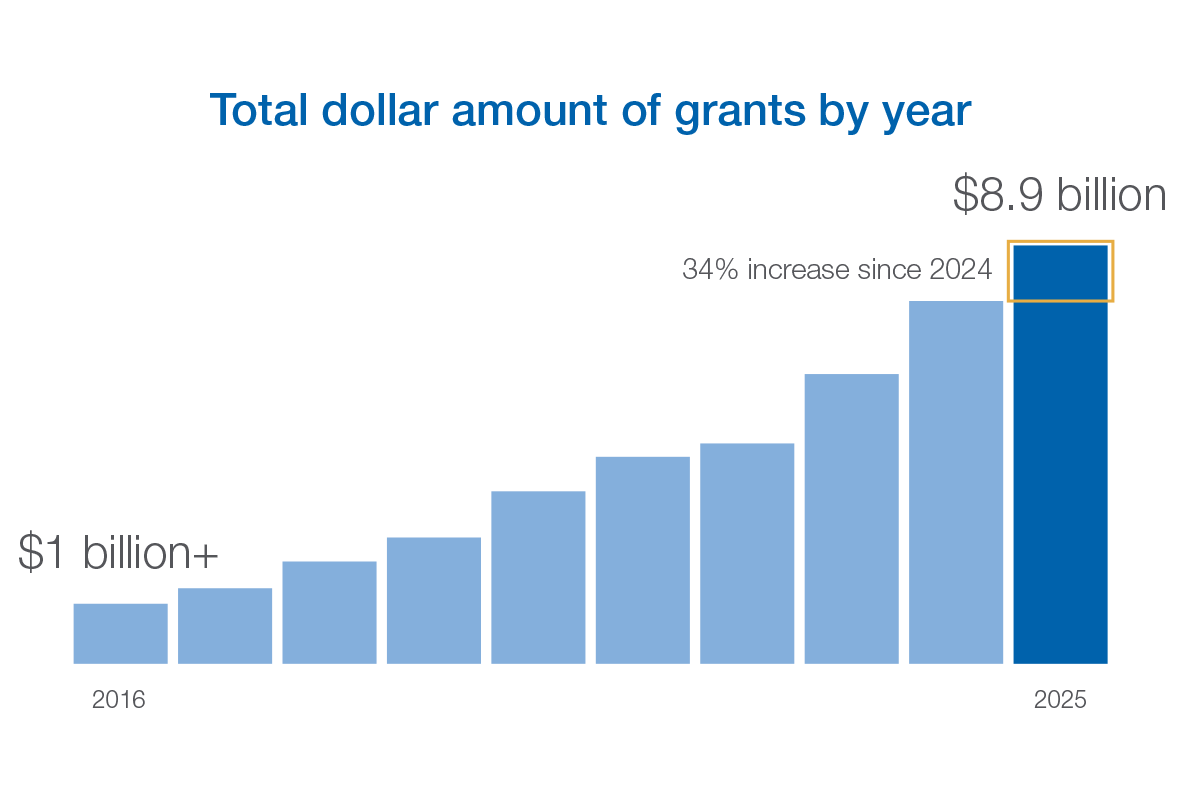

In our last fiscal year, DAFgiving360™ donors gave to charity at historic levels. We're honored to support their philanthropic goals.

5 key trends amongst DAFgiving360 donors

- Giving knows no season—donors grant year-round

- Disaster relief needs draw ongoing support

- Donors expand generosity while staying rooted in community

- Donors put investments to work to increase impact

- Advisor relationships drive strategic giving

Giving knows no season—donors grant year-round

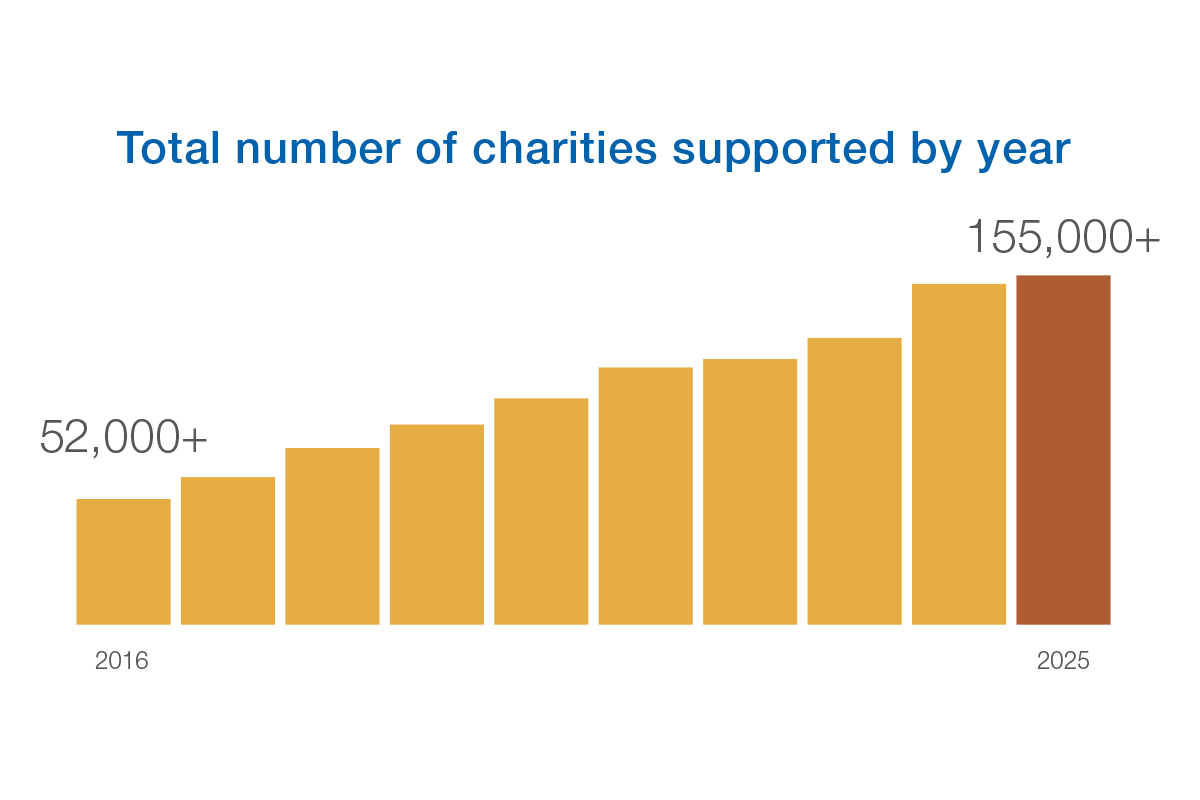

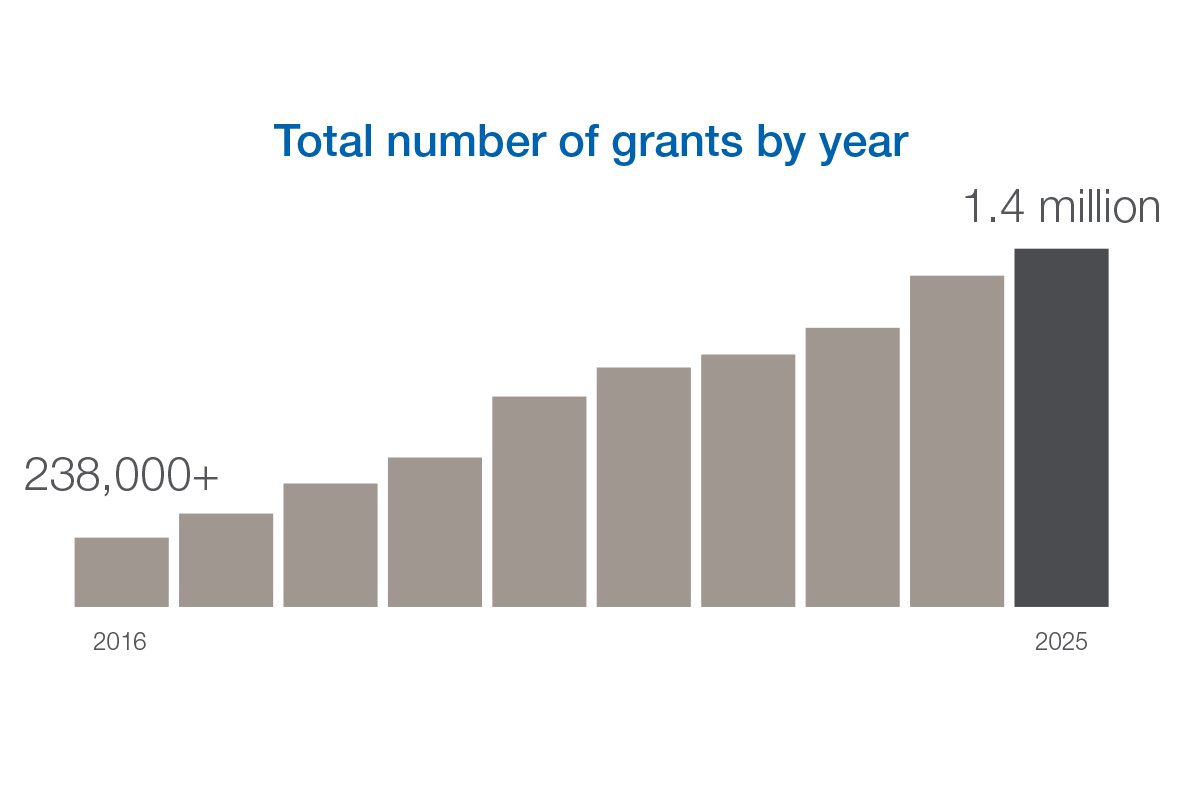

Giving is a year-round priority for donors. In fiscal year 2025, DAFgiving360 donors supported 155,000 charities through 1.4 million grants, a 19% increase in grants year over year. For every contribution made to DAFgiving360, 12 grants were made to charity. Throughout the year, donors granted to charity at a pace averaging more than $24 million per day.

Because contributions to DAFs are set aside for charitable use, donors have the flexibility to provide ongoing support to their favorite charities throughout the year. Over the last 12 months, 38% of grants were scheduled as recurring to provide continual support for charities.

Disaster relief needs draw ongoing support

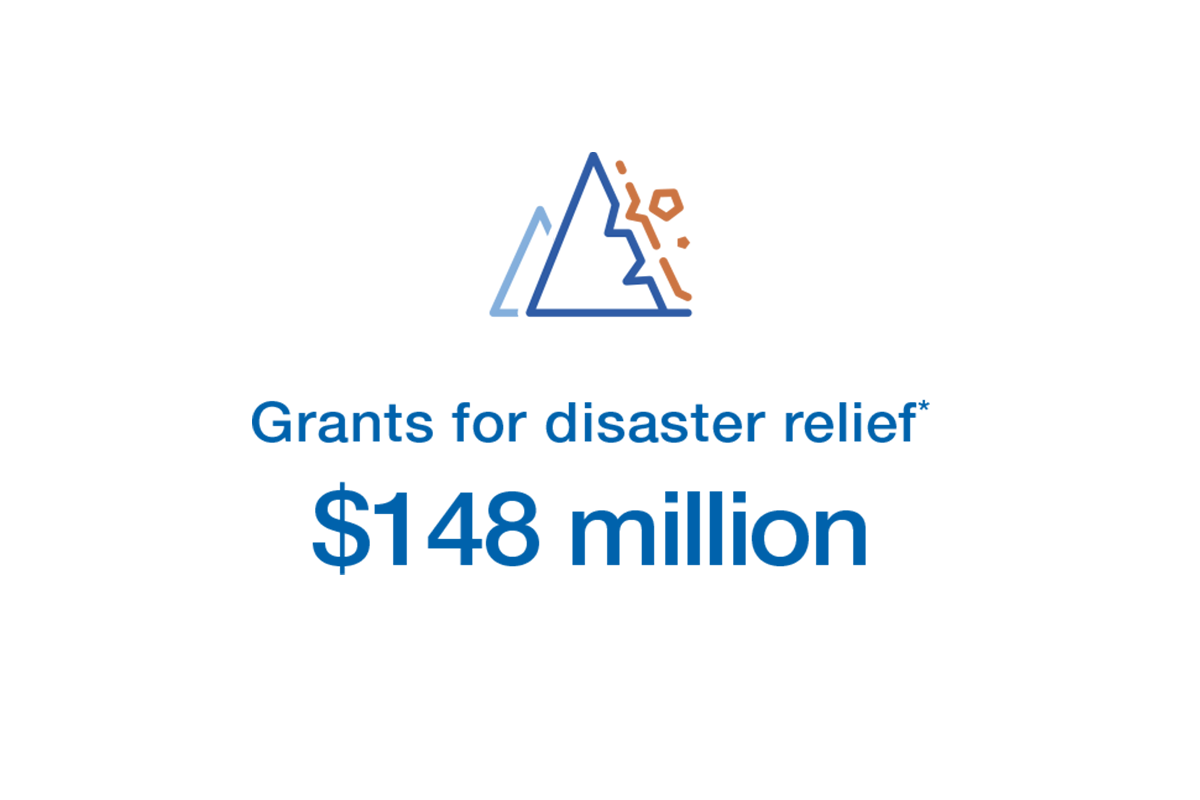

Emergency events—from floods to tornadoes—prompted rapid-response support from donors in fiscal year 2025. In total, $148 million was distributed for disaster relief efforts.

For example, just weeks into fiscal year 2026, DAFgiving360 donors recommended more than $4 million in grants to support relief and recovery efforts for Texas flood victims.

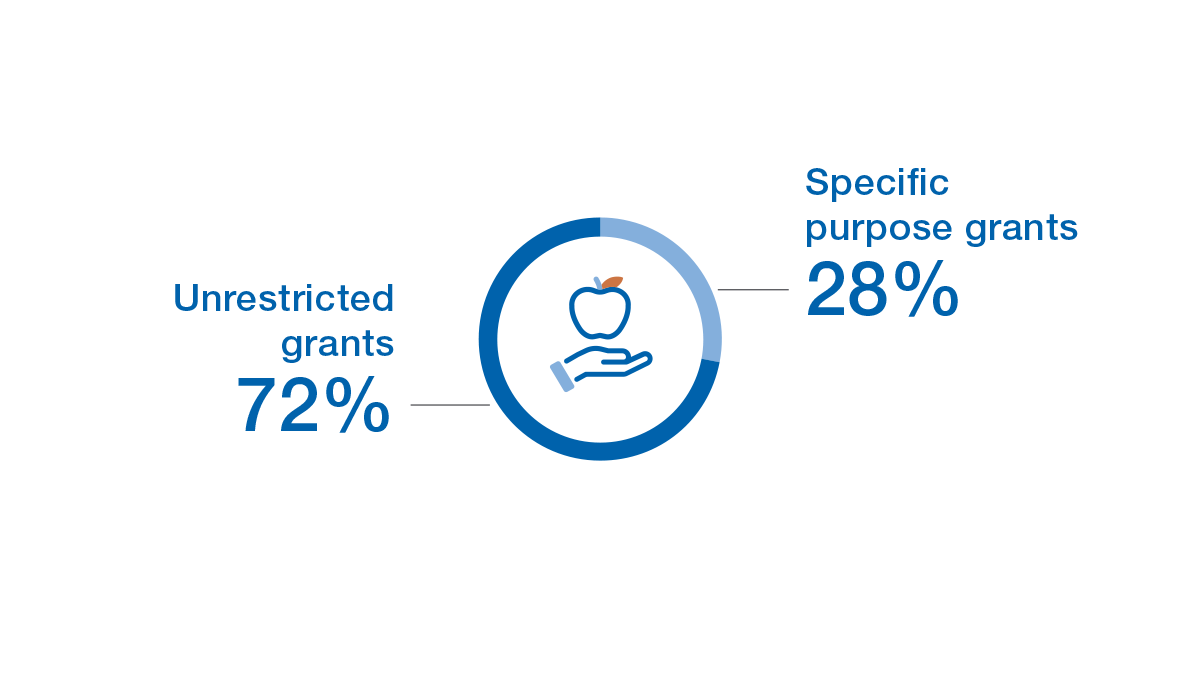

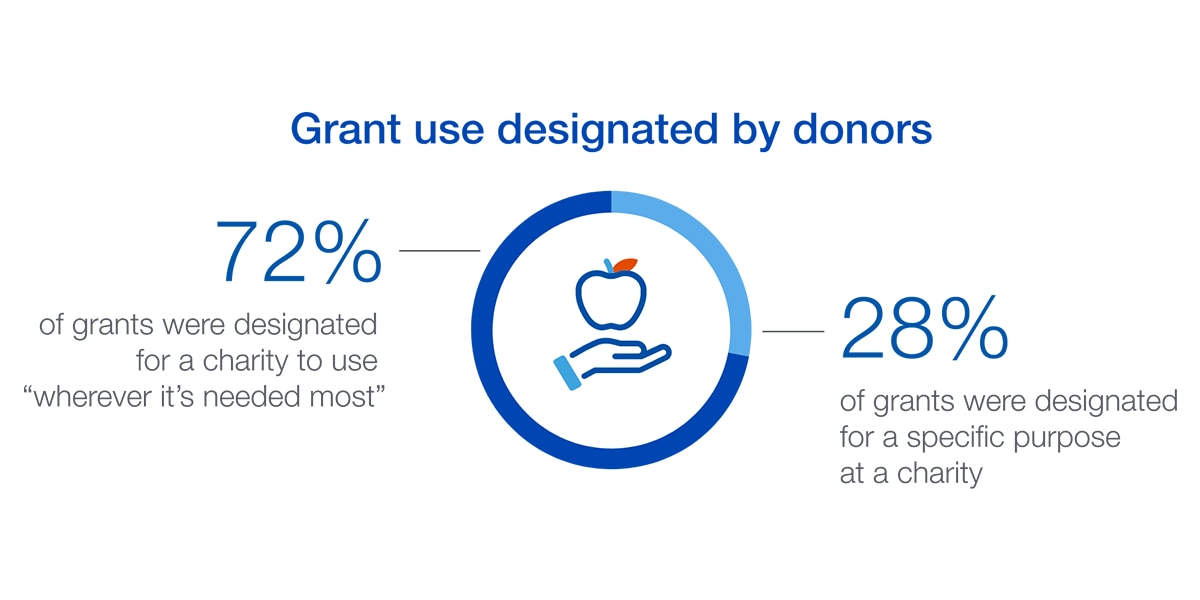

Donors recommend more “unrestricted” grants: There was a 20% year-over-year increase in the number of grants that did not specify a purpose, empowering nonprofits to quickly use the funds where needed most, and this flexibility is helpful after disasters.

Grants for disaster relief: Over $148 million was granted to support those affected by emergency events like floods.

Donors expand generosity while staying rooted in community

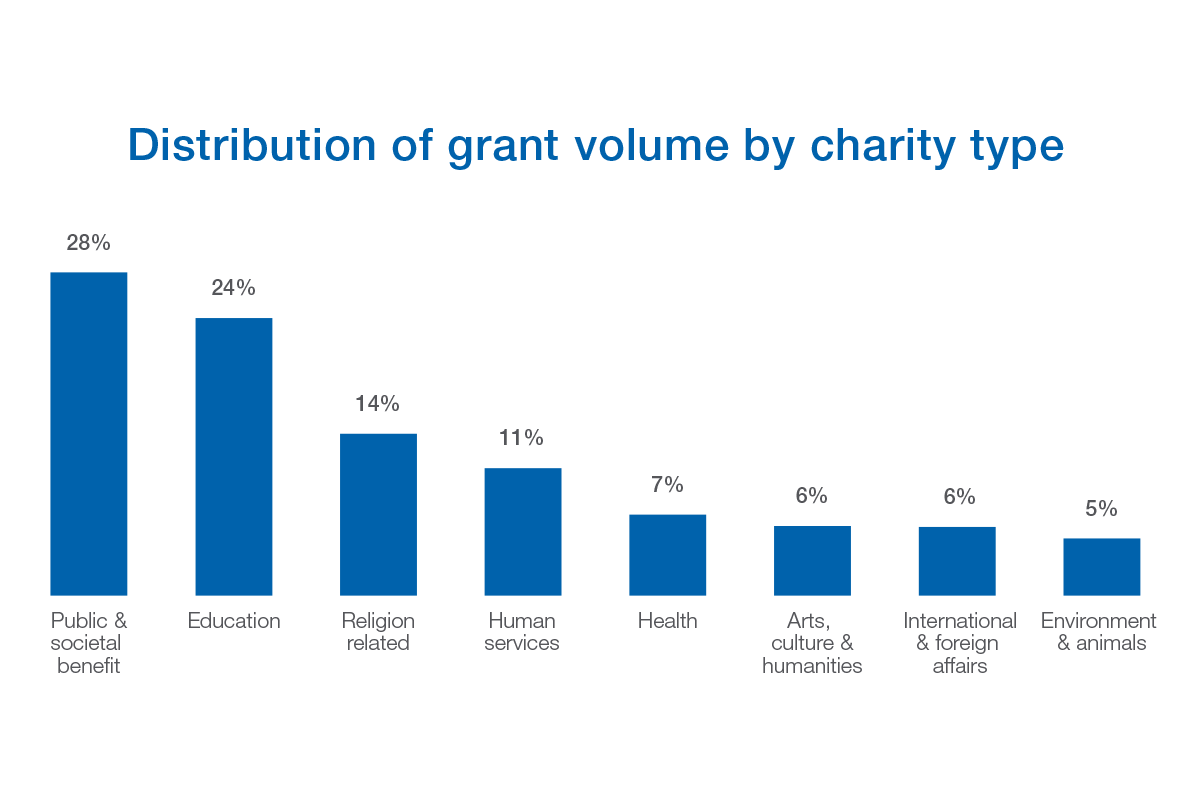

Since DAFgiving360 was established in 1999, the organization has helped individuals and families across generations give more than $44 billion to over 280,000 charities. In fiscal year 2025, our donors’ support spanned across all charity types, with the highest percent of their grant recommendations going to charities in the public and education sectors.

DAFgiving360 donors also expanded their giving to many charities that were new to them while continuing to support the organizations they had previously.

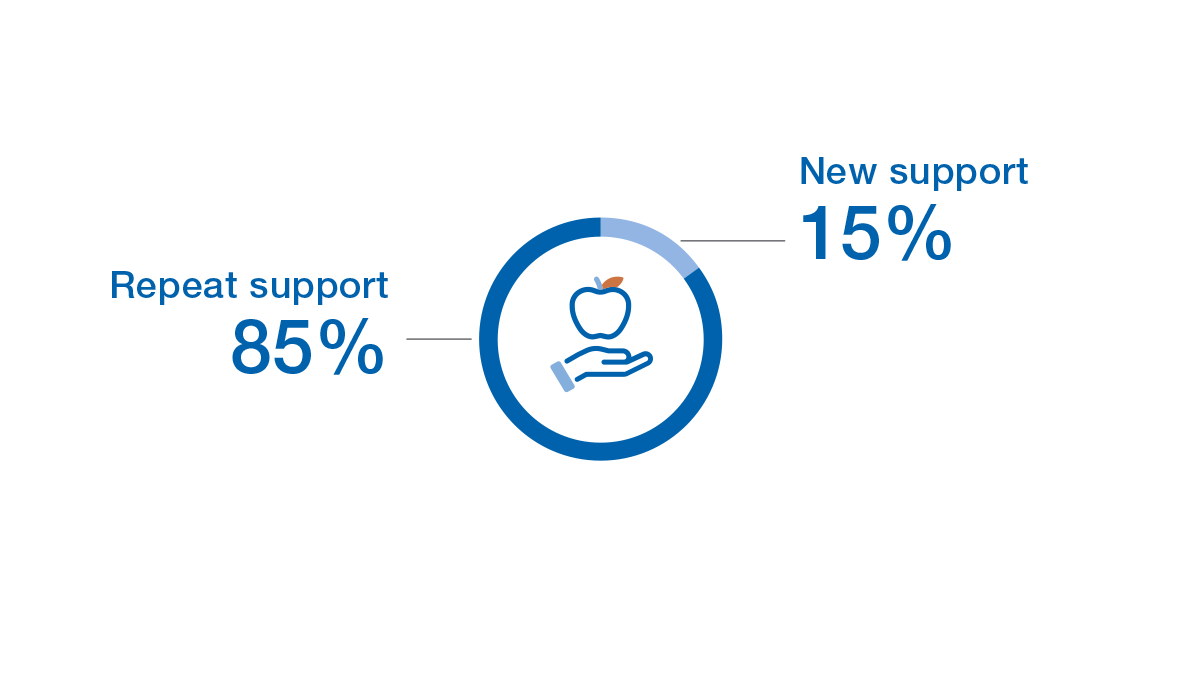

Repeating vs. Net-new donations: This year, 85% of grants went to charities that donors had previously supported, while 15% of grants went to charities that were new for those donors.

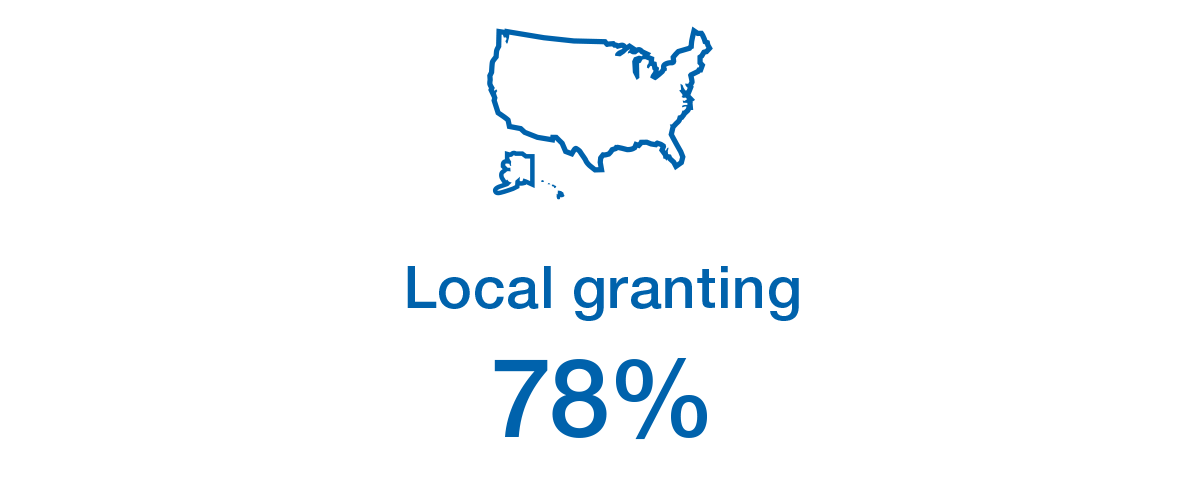

Local granting: Donors continue to prioritize causes close to home, with 78% of all donors granting within their own states last year.

Donors put investments to work to increase impact

A majority of donors look for opportunities across their financial portfolios and plans to make the biggest impact on the causes they support.

One of the most compelling features of a donor-advised fund (DAF) account is the ability to recommend how contributed assets are invested while in the account. The assets invested aren’t subject to capital gains taxes, meaning that any potential growth in the account may equate to more assets available to grant to charity.

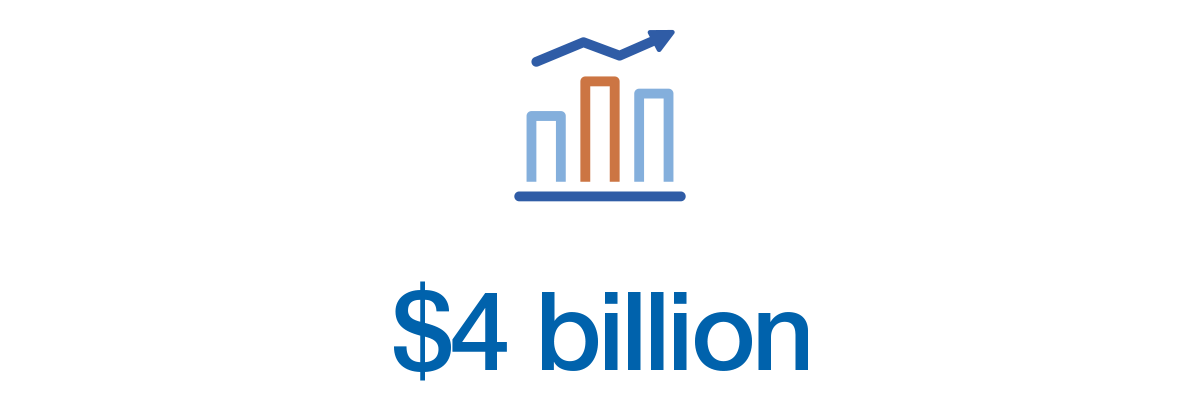

Increased impact through DAF investment: Investment growth in fiscal year 2025 created an additional $4 billion available for grants to charity.

Appreciated, long-term held assets can unlock additional funds for charity: 63% of contributions in fiscal year 2025 were in the form of non-cash assets like stocks, real estate, or private business interests. Contributions of appreciated, long-term held assets can unlock additional funds for charity by potentially eliminating the capital gains tax donors would incur if they sold the assets and donated the cash proceeds thereafter, which may increase the amount available for grants to charity by as much as 20%.

Advisor relationships drive strategic giving

According to Schwab's 2025 RIA Benchmarking Study, 86% of advisor firms offer charitable planning. During economic and market volatility at the start of 2025, many donors worked with advisors on strategies such as bunching gifts to meet their charitable goals.

Donor satisfaction

DAFgiving360's mission is to increase charitable giving in the U.S. DAFgiving360 does this by providing a tax-smart and simple giving solution of a donor-advised fund (DAF) account to donors and financial advisors.

In a January 2025 survey, we found that:

- 74% of donors rated their overall satisfaction as a 9 or 10, with 10 being the highest.

- 72% of donors said having a DAF account increases their charitable giving.

Learn more about increasing charitable impact

For questions or assistance with philanthropic planning or charitable giving, you and your advisors may:

Talk to a charitable specialist at 800-746-6216

Follow DAFgiving360 on LinkedIn